IRS 4598E 2003-2026 free printable template

Show details

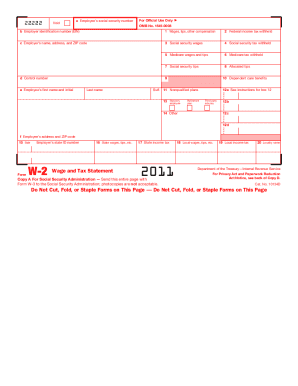

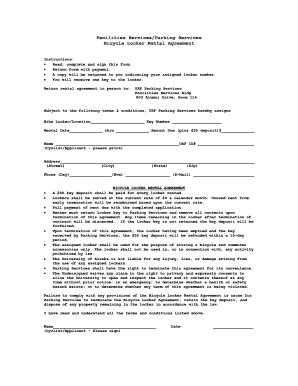

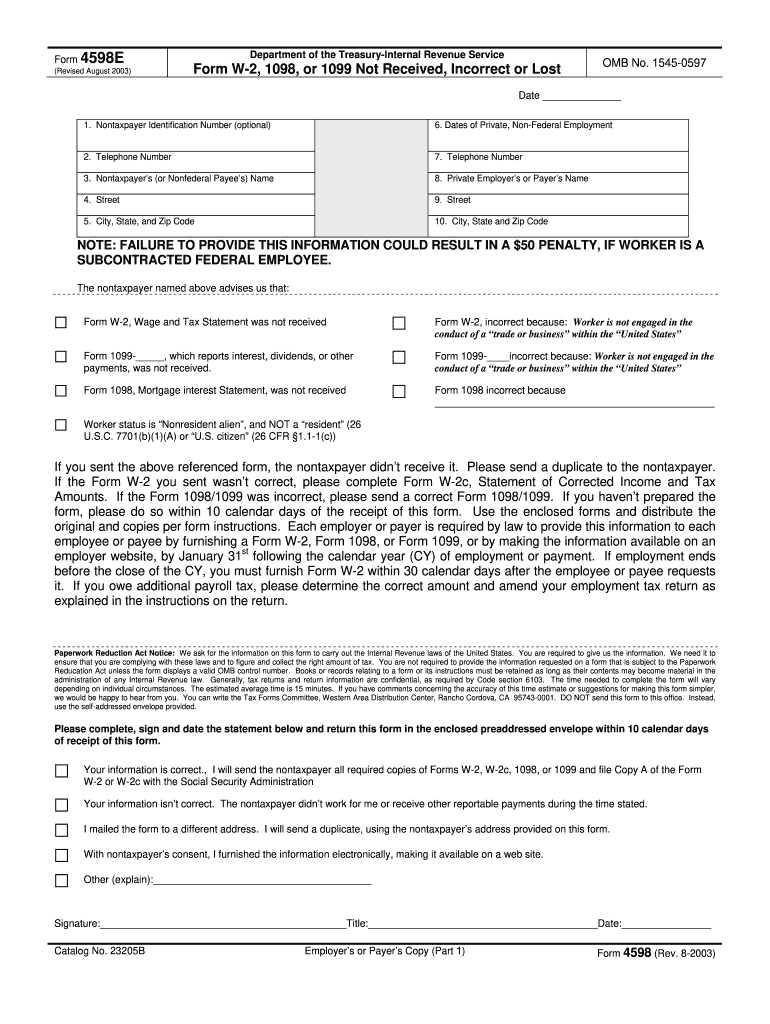

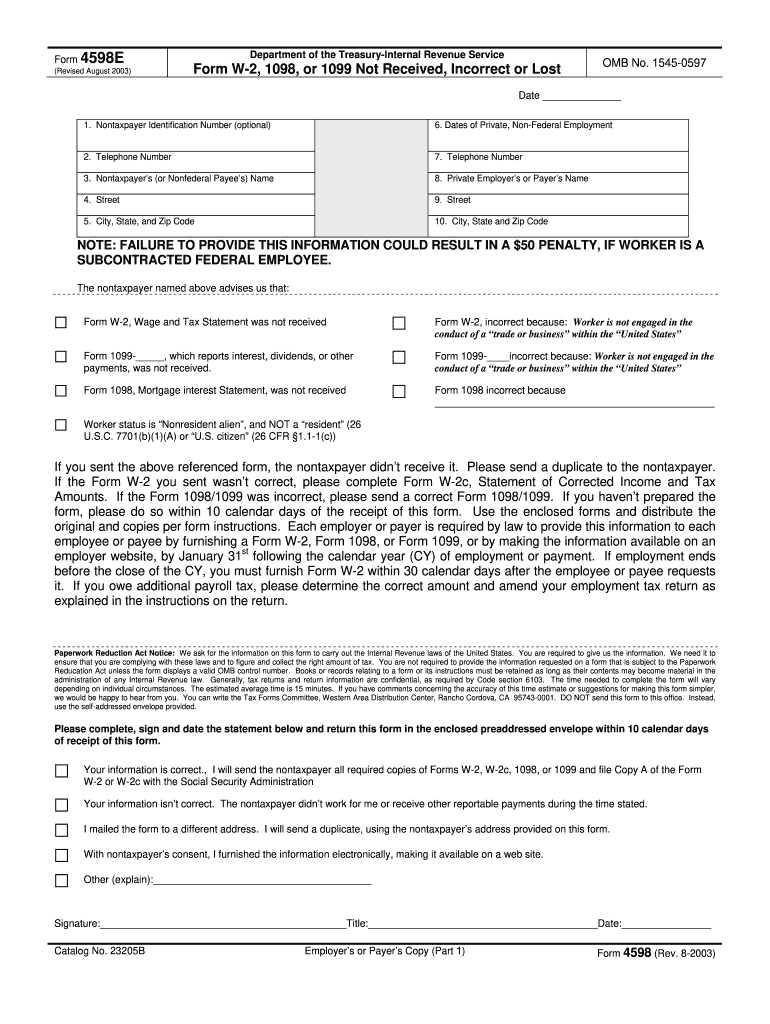

Other explain Signature Title Date Catalog No. 23205B Employer s or Payer s Copy Part 1 Form 4598 Rev. 8-2003 If you don t receive the Form W-2 or W-2c Statement of Corrected Income and Tax Amounts by the date your tax return should be filed please file your return with the enclosed Form 4852 showing an estimate of your wages and withholding. Form 4598E Revised August 2003 Department of the Treasury-Internal Revenue Service Form W-2 1098 or 1099 Not Received Incorrect or Lost OMB No*...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign irs form 4598

Edit your 4598 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 4598 irs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 4898 online

To use our professional PDF editor, follow these steps:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit irs form 13818. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out what is a w 9 form

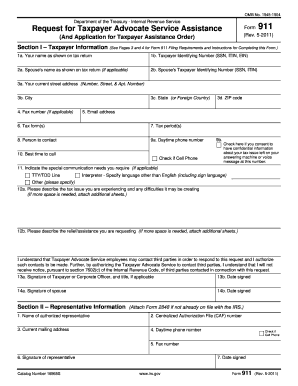

How to fill out IRS 4598E

01

Obtain IRS Form 4598E from the IRS website or relevant tax authority.

02

Fill in your personal information at the top of the form, including your name, address, and social security number.

03

Review the instructions provided with the form to understand the specific information required.

04

Complete each section of the form, ensuring all numbers are accurate and correctly calculated.

05

If applicable, attach any necessary documentation that supports your application.

06

Review the entire form for any errors or omissions.

07

Sign and date the form where indicated.

08

Submit the form to the appropriate IRS address as per the instructions provided.

Who needs IRS 4598E?

01

Individuals or entities seeking tax relief or assistance due to financial difficulties may need IRS Form 4598E.

02

Taxpayers who have experienced a significant financial loss or hardship that affects their tax obligations.

03

Those looking to establish a repayment plan or modify existing tax liabilities may also require this form.

Fill

form

: Try Risk Free

People Also Ask about

Do I need form 5498 for my taxes?

Even though Form 5498 reports Roth IRA contribution information, you won't need the form to file taxes unless you're trying to qualify for the Retirement Savings Contributions Credit (Saver's Credit). Only employers can claim a tax deduction for the SEP-IRA and SIMPLE IRA contributions listed on Form 5498.

What is tax form 4598 for?

Irs Form 4598 Instructions PDF Details The form can be used to report, among other things, distributions from pension and profit-sharing plans, IRA distributions, taxable social security benefits, and certain types of gambling winnings.

What is form 5498 used for?

The information on Form 5498 is submitted to the IRS by the trustee or issuer of your individual retirement arrangement (IRA) to report contributions, including any catch-up contributions, required minimum distributions (RMDs), and the fair market value (FMV) of the account. For information about IRAs, see Pubs.

What is form 8606 used for?

Use Form 8606 to report: Nondeductible contributions you made to traditional IRAs. Distributions from traditional, SEP, or SIMPLE IRAs, if you have ever made nondeductible contributions to traditional IRAs. Conversions from traditional, SEP, or SIMPLE IRAs to Roth IRAs.

Do I need to attach form 5498 to my tax return?

No. You aren't required to do anything with Form 5498 because it's for informational purposes only. Please be sure to keep this form for your records as you'll need this information to calculate your taxable income when you decide to take distributions from your IRA.

Fill out your IRS 4598E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 4598e is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.